As of 7 August 2025, President Trump had signed 187 Executive Orders (EO.) On that day in August, President Trump signed the EO “Guaranteeing Fair Banking for All Americans.” This EO prohibits politicized or unlawful debanking. It identifies several areas where law-abiding Americans have experienced discrimination. It also looks like legislation that really needs to become law here in Indiana.

Terms such as “debanking” may seem unfamiliar and new. Banks close your accounts, card processors won’t work with you, you can’t get a loan. Unfortunately, this is not new. These problems are compounded by the heavy reliance on debit and credit cards, and the fact the number of banks (per the Federal Deposit Insurance Corporation/FDIC) in the United States have decreased by 72% since 1982.

This EO orders the removal of “reputational risk” (from what I can tell, reputational risk comes from dealing with people with different political view) and other concepts that enable debanking. It directs the Small Business Administration to not take similar actions when it comes to business loans.

From the EO, sums up a lot: Within 180 days of the date of this order, the Secretary of the Treasury, in consultation with the Assistant to the President for Economic Policy, shall develop a comprehensive strategy for further measures to combat politicized or unlawful debanking activities of financial regulators and financial institutions across the Federal Government, including consideration of legislative or regulatory options to eliminate such debanking.

“Unlawful debanking activities of financial regulators” is in bold for my emphasis. Operation Chokepoint was started in the Obama Administration to cut off certain entities from banking, card processing, etc. The 2nd Amendment (2A) doesn’t mean much to some.

Here in the Great State of Indiana, legislation very similar to this EO has been introduced over the past few years. We made progress in 2024 with legislation that was passed which impacted card processors who discriminate against law abiding Hoosiers. They can discriminate, but the State of Indiana will do no business with them. That is a big stick. Getting similar legislation passed that affects banks and financial institutions has been an uphill battle.

In 2024 I was not new to the Indiana Statehouse on 2A issues, but I was new to the issues of debanking. Around the time the Indiana General Assembly session started, US Representative from Ohio Jim Jordan released a report concerning debanking and surveillance of gun owners by financial institutions. Keywords such as “Trump” and “MAGA” being flagged (as well as purchases of the Holy Bible) made the news cycle. That was in the first paragraph of a five-page press release. The more I researched, the more I realized this has been going on for years. I also realized that under the guise of looking for the next mass-shooter or a terrorist organization, financial institutions were creating a database of gun owners by tracking card transactions. Would anyone who was looking for mass-shooters and terrorists track debit/credit card transactions at Delta Defense (the management company for the US Concealed Carry Association,) Dillon Precision (makers of reloading equipment,) GovX.com (great deals for military, veterans, and first-responders,) and Smokey Mountain Knife Works (who makes… knives.)

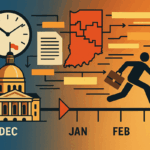

Not long ago I was in an email discussion concerning the upcoming 2026 Indiana General Assembly session. I laid out five different potential bills and the chances of getting the bill passed into law. The first potential bill I noted was very similar to the Guaranteeing Fair Banking for all Americans EO. Prior to 7 August my view was that we should focus elsewhere. I believe I typed something along the lines of, “It’ll never get a hearing and will die in committee.” Since 7 August? I think we can make this happen. A bill in the Indiana General Assembly that strongly resembles an EO signed by the President who carried 88 of Indiana’s 92 counties? I think I just found the closing statement for my testimony. If we can get the bill a hearing.

If you are reading this, you are a gun owner and a 2A supporter. You are also on the front lines of the fight for our 2A Rights. In January when you see a Legislative Action Alert concerning banking discrimination? Be ready to let your elected officials know we are out here, and we are paying attention.